10 advantages you should hire a Medicare agent before choosing your plan

Reveal the Reasons You Need to Locate a Medicare Advisor for Your Protection

Guiding with the intricacies of Medicare can be daunting for many people. With various insurance coverage choices and strategies, understanding what ideal fits one's health and wellness needs and economic situation is vital. A Medicare advisor uses personalized advice to help make informed selections. The factors to seek their experience expand past simply initial registration. There are vital variables that can considerably affect long-term health outcomes and financial stability.

Understanding the Medicare Landscape

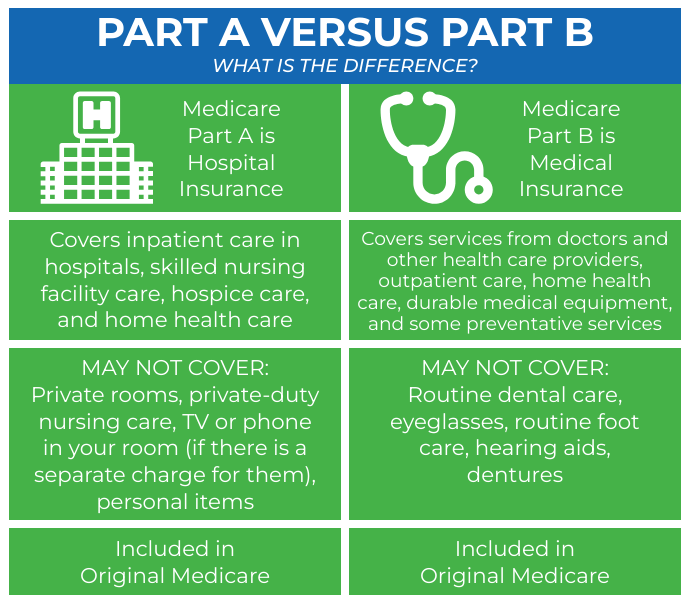

What elements should individuals consider when navigating the intricacies of Medicare? One crucial element is understanding the various components of Medicare: Component A covers medical facility insurance coverage, while Component B concentrates on clinical insurance policy. Individuals need to also understand Medicare Benefit Program, which offer a different means to get Medicare advantages through personal insurers. Additionally, experience with prescription medicine insurance coverage under Part D is essential, as it can considerably impact out-of-pocket costs for drugs.

An additional crucial consideration is eligibility and registration durations. Missing out on target dates can cause fines or voids in insurance coverage. Individuals must additionally examine their distinct healthcare requirements, including favored providers and necessary therapies. Finally, economic variables, such as premiums, deductibles, and co-pays, have to be reviewed to ensure that the chosen strategy straightens with their budget plan. By thoroughly examining these components, individuals can better browse the Medicare landscape and make notified decisions concerning their health care coverage.

Personalized Support Tailored to Your Demands

Customized advice is vital for people steering the intricacies of Medicare. A knowledgeable advisor can provide tailored plan recommendations that align with particular health and wellness requirements and economic circumstances - Medicare advisor. This customized approach streamlines the decision-making procedure, ensuring that beneficiaries select the very best choices offered

Custom-made Strategy Suggestions

Lots of people looking for Medicare protection benefit significantly from tailored plan suggestions that line up with their unique medical care requirements and financial scenarios. These customized recommendations take into account variables such as existing medical conditions, prescription medicine needs, and budgetary constraints. By analyzing an individual's health background and future healthcare expectations, advisors can recommend strategies that use the important benefits while decreasing out-of-pocket expenses. In addition, personalized recommendations ensure that people comprehend their options, empowering them to make educated options. This customized technique not just improves contentment with the selected insurance coverage but additionally assists in staying clear of unnecessary costs or spaces in care. Eventually, customized plan referrals function as a critical source for those traversing the complexities of Medicare.

Navigating Complex Choices

As individuals come close to the decision-making process for Medicare protection, navigating via the complex range of options can commonly feel frustrating. With various strategies, benefits, and qualification needs, the choices might appear frightening. This complexity necessitates personalized assistance tailored to private needs. A Medicare advisor can supply quality, helping clients comprehend the nuances of each alternative and just how they align with their healthcare demands and financial scenarios. Advisors examine individual health histories, preferences, and budget plan constraints to advise one of the most ideal strategies. By leveraging their experience, people can confidently browse the intricacies of Medicare, guaranteeing they pick insurance coverage that best fulfills their requirements without unnecessary complication or anxiety. Engaging a Medicare advisor eventually enhances and streamlines the decision-making procedure satisfaction with chosen strategies.

Optimizing Your Benefits and Protection

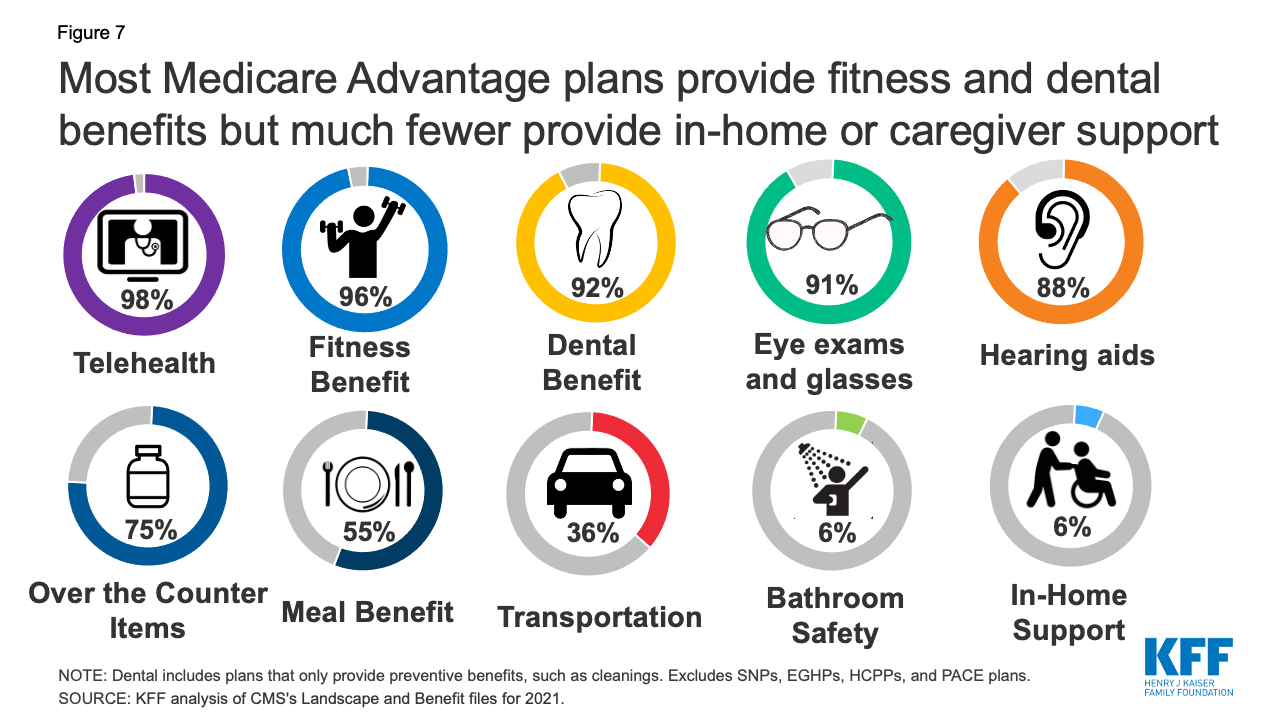

How can one assure they are fully leveraging their Medicare benefits and protection? Involving a Medicare advisor can be an important step in this procedure. These professionals have thorough knowledge of the different Medicare strategies and can help people comprehend which choices best suit their healthcare needs. By reviewing individual clinical background, prescription medicines, and chosen doctor, an expert can assist recipients towards strategies that supply suitable coverage.

Furthermore, advisors might help in determining supplemental insurance choices, such as Medigap or Medicare Advantage, which can boost total advantages. They also supply insights right into preventive services offered under Medicare, guaranteeing people make the most of health brows through and screenings. Eventually, a specialized Medicare advisor empowers recipients to make educated decisions, ensuring they optimize their advantages and insurance coverage while reducing out-of-pocket expenditures. This strategic technique leads to much better health care results and economic assurance.

Browsing Enrollment Periods and Target Dates

When should people pay closest interest to Medicare registration durations and due dates? Comprehending these durations is crucial for protecting the ideal coverage. The Preliminary Enrollment Period (IEP) begins three months prior to a private turns 65 and lasts seven months, enabling enrollment in Medicare Part A and Component B.

Subsequent enrollment durations, such as the Yearly Registration Period (AEP) from October 15 to December 7 every year, give opportunities to make adjustments to existing strategies or register in brand-new ones.

Additionally, Special Registration Durations (SEPs) might get those experiencing certifying life occasions, such as moving or shedding various other health insurance coverage. Missing out on these crucial windows can bring about delays in coverage or raised costs - Medicare advisor. Because of this, consulting a Medicare advisor can assist individuals browse get more info these durations effectively, guaranteeing they make notified choices that straighten with their health care needs

Staying Clear Of Expensive Mistakes

Recognizing Strategy Options

Navigating the complexities of Medicare strategy options can be daunting for many people. With various parts-- A, D, b, and c-- each supplying distinct benefits, understanding these selections is important to stay clear of pricey errors. People typically misinterpret protection information, resulting in unanticipated out-of-pocket expenditures or voids in care. For circumstances, stopping working to identify the differences in between Initial Medicare and Medicare Advantage can cause insufficient insurance coverage for details health and wellness needs. Additionally, overlooking supplementary plans may leave recipients at risk to high expenses. Involving a Medicare advisor can offer customized advice, making certain people select the appropriate plan customized to their health demands and economic situation. This positive method can significantly enhance general fulfillment with Medicare protection.

Navigating Registration Target Dates

Comprehending registration deadlines is vital, as missing them can lead to considerable monetary charges and voids in protection. Medicare has certain durations, consisting of the Initial Enrollment Period, General Enrollment Duration, and Unique Registration Periods, each with special timelines. A Medicare advisor can assist individuals navigate these vital dates, ensuring they register when eligible. Failure to follow these target dates might lead to postponed insurance coverage, greater costs, or also lifetime charges. Advisors provide customized reminders and assistance to aid customers recognize their alternatives and timelines. By looking for expert guidance, recipients can stay clear of costly errors and safeguard the coverage they require without interruption. Correct planning can make a substantial difference in optimizing Medicare advantages and minimizing out-of-pocket expenditures.

Staying Educated Regarding Modifications in Medicare

As adjustments to Medicare policies and policies take place consistently, it becomes essential for recipients to remain educated. Medicare agents in. Understanding these modifications can considerably impact the insurance coverage options offered and the costs related to them. Medicare advisors play an important function in maintaining clients updated about new plans, benefits, and potential risks

Recipients need to actively involve with several resources of info, consisting of main Medicare statements, credible healthcare sites, and community workshops. Regular review of these sources helps assure that people know any modifications that could impact their insurance coverage or eligibility.

Furthermore, understanding adjustments in Medicare can empower recipients to make enlightened decisions regarding their medical care. This understanding can lead to better financial preparation and boosted health care end results. Inevitably, remaining educated is not simply beneficial; it is a necessity for navigating the intricacies of Medicare successfully.

Building a Long-Term Relationship for Future Needs

While lots of recipients focus on instant needs and modifications in their Medicare plans, building a long-term relationship with a Medicare advisor can offer ongoing advantages that expand well past preliminary registration. Medicare agent near me. A dedicated advisor works as a regular resource, using understandings right into advancing healthcare options and legal modifications that might affect coverage

As beneficiaries age, their health care needs typically transform, making it essential to have a person who recognizes their unique circumstance and can recommend proper adjustments. This relationship promotes count on and warranties that recipients receive tailored advice, maximizing their advantages while lessening prices.

Regularly Asked Inquiries

What Qualifications Should I Search for in a Medicare Advisor?

When seeking a Medicare advisor, one should focus on qualifications such as qualification in Medicare preparation, considerable experience in the field, expertise of different plans, and a strong credibility for offering individualized, unbiased suggestions tailored to individual requirements.

Exactly How Much Does Hiring a Medicare Advisor Commonly Price?

Working with a Medicare advisor generally sets you back between $0 to $500, relying on the solutions supplied. Some advisors get compensations from insurance business, making their consultations complimentary for clients, while others might bill a flat fee.

Can a Medicare Advisor Aid With Prescription Medicine Strategies?

A Medicare advisor can assist people in guiding through prescription medicine strategies by evaluating choices, contrasting expenses, and making sure recipients choose a plan that fulfills their requirements, eventually boosting their healthcare experience and economic planning.

Are Medicare Advisors Available in All States?

Yes, Medicare advisors are readily available in all states. They offer assistance to people traversing Medicare choices, guaranteeing accessibility to essential details and resources tailored to every person's special medical care needs and conditions.

Just how Frequently Should I Seek Advice From My Medicare Advisor?

Consulting with a Medicare advisor each year is advised, specifically throughout open enrollment durations. Individuals may benefit from additional assessments when experiencing considerable life adjustments or when requiring clarification on brand-new coverage options or benefits.

People should likewise be mindful of Medicare Benefit Plans, which offer a different means to get Medicare advantages via personal insurers. Inevitably, a committed Medicare advisor equips recipients to make informed decisions, ensuring they maximize their advantages and protection while minimizing out-of-pocket costs. Falling short to identify the differences between Initial Medicare and Medicare Advantage can result in inadequate protection for specific health and wellness demands. Engaging a Medicare advisor can offer personalized support, guaranteeing individuals pick the appropriate plan customized to their health and wellness needs and monetary circumstance. While lots of recipients focus on prompt demands and modifications in their Medicare strategies, developing a lasting relationship with a Medicare advisor can provide recurring benefits that extend well beyond initial enrollment.